Interest rates are very important in the world of finance. They affect how the stock market performs, which can influence both companies and investors. Understanding how interest rates work can help people make better decisions about their investments.

How Interest Rates Affect Companies

One of the main ways interest rates impact the stock market is through the cost of borrowing money. When interest rates go up, it becomes more expensive for companies to take out loans. This means they might spend less on new projects or expansion, which can lead to lower profits. If companies are not making as much money, their stock prices may drop. On the other hand, when interest rates are low, borrowing is cheaper. This encourages companies to invest in growth, which can lead to higher profits and rising stock prices.

Consumer Spending and Economic Growth

Interest rates also affect how much consumers spend. When interest rates are high, loans for things like cars and homes become more expensive. As a result, people may spend less money, which can slow down the economy. If consumers are not spending as much, companies may earn less money, leading to lower stock prices. Conversely, when interest rates are low, borrowing costs decrease. This encourages people to spend more, helping the economy grow and boosting stock prices.

Investor Sentiment

Investor sentiment is how investors feel about the market and their investments. Changes in interest rates can greatly influence these feelings. When interest rates rise, some investors may decide to move their money from stocks to safer investments like bonds that offer better returns. This shift can cause stock prices to fall because there is less demand for stocks. However, when interest rates drop, many investors look for higher returns in the stock market, which can push prices up.

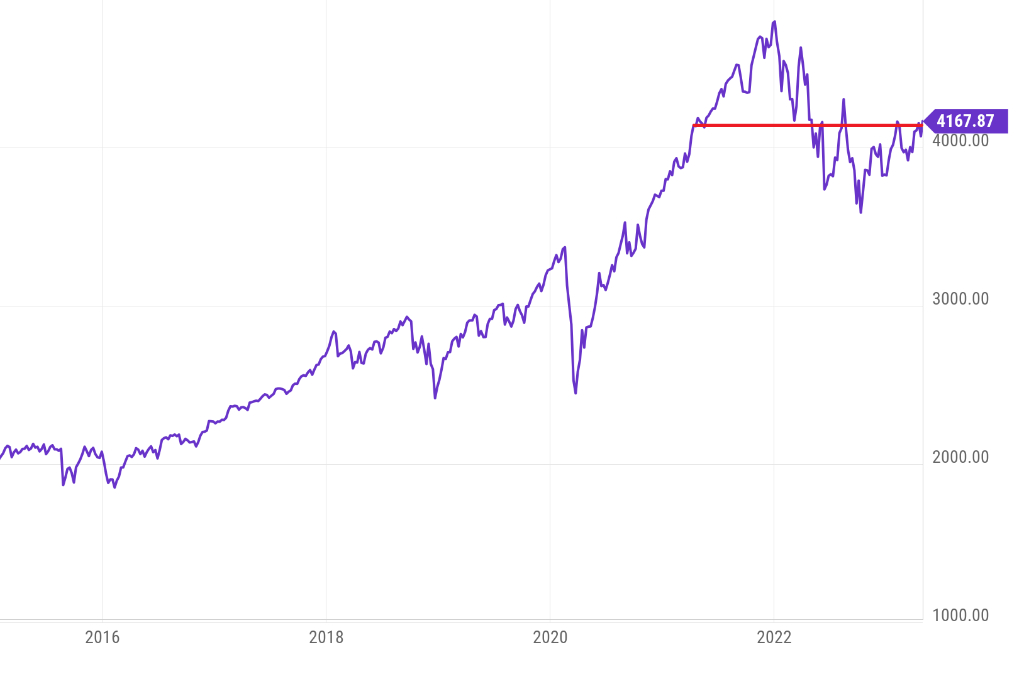

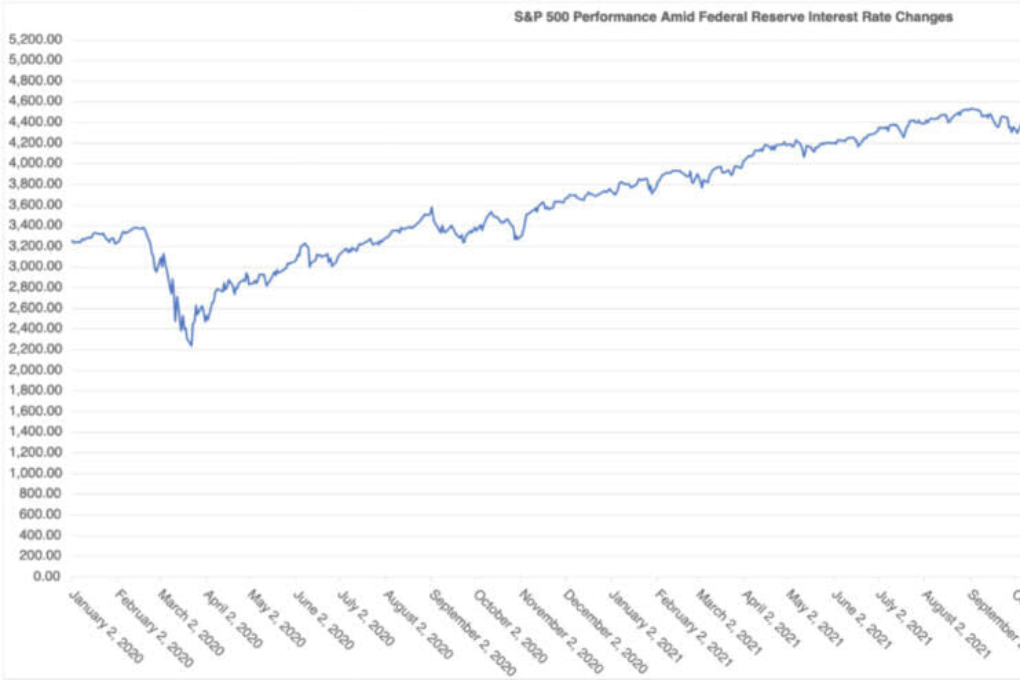

Historical Examples

Looking at history helps us understand how interest rates and the stock market interact. For example, when central banks raise interest rates during a strong economy, it may not always lead to falling stock prices because investors often see this as a sign of growth. During the COVID-19 pandemic, many central banks lowered interest rates to help support struggling economies. As economies began to recover and inflation became a concern in 2022, rates were raised again, causing quick reactions in the stock market.

Interest rates have a big impact on how the stock market performs. Higher interest rates usually lead to lower stock prices because they increase borrowing costs and reduce consumer spending. Lower interest rates can help boost economic growth and increase company profits, leading to higher stock prices. Investors need to pay attention to changes in interest rates as they can greatly affect their investment choices and overall market performance. Understanding this relationship is important for anyone looking to navigate the financial world successfully.